Solar energy in the European Union also performed exceptionally well in 2021 despite adverse market conditions on several fronts – from the ongoing negative impact of COVID-19 on our daily lives, to PV product supply shortages and subsequent price increases of solar units.

As predicted, demand for solar energy in the European Union has grown significantly in 2021. The 27 EU member states saw around 25.9 GW of new solar PV capacity connected to their grids in 2021, up 34% from 19.3 GW installed last year. This growth makes 2021 not only another record year for solar in the EU, but also the best year on record, coming exactly a decade after the previous record set at 21.4 GW in 2011.

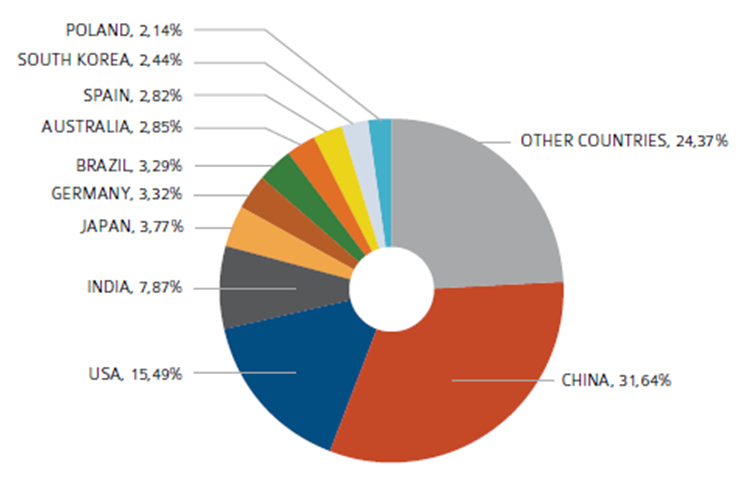

Germany is again Europe's largest solar market in 2021 with 5.3 GW of new installed capacity, followed by Spain (3.8 GW), the Netherlands (3.3 GW), Poland (3.2 GW ) and France (2.5 GW).

In 2021, the top five markets in the European Union remained the same and among the top 10, there are only 2 new entrants from Northern Europe (Denmark and Sweden), replacing two established PV markets, one in central Europe (Belgium), one in the south ( Portugal). In 2021, 25 of the 27 EU member states deployed more solar energy than the previous year.

The EU's solar generation fleet grew by 19% to 164.9 GW, up from 139 GW in 2020, when growth was also in double digits, but at 16%.

The EU's solar power portfolio is still dominated by two countries – Germany (59.9 GW) and Italy (22 GW) currently operate around 50% of solar power generation resources – in 2020, their combined share was 55%.

As impressive as Germany's annual capacity and operating fleet of electricity at the end of 2021 may be, in terms of solar power per capita, the EU's most populous member state is no longer No. 1 – that honor now belongs to Netherlands.

Analysis of solar developments in EU Member States' National Solar Energy Climate Plans (NECPs) shows that two countries have already met their 2030 NECP targets in 2021, and more than half of EU Member States will their 2030 targets within the scope of this perspective period, to the end of 2025.

For most Member States, more energy additions are again expected in the 4-year installation forecasts than in last year's outlook. Backed by Germany's new government's ambitious announcement to double its 2030 solar power target to 200 GW, Europe's top market will become even more central to the continent's solar sector. Germany is expected to install 47.7 GW by 2025, almost as much as we estimate for the next three solar markets combined – Spain, the Netherlands and France.

This year's EU Market Outlook PV market scenarios for 2022 to 2025 show continued, double-digit annual growth rates that are all slightly higher than in our previous edition. The Medium Scenario now projects growth rates of 18-20% compared to levels of 16-17% last year, adding about 162.7 GW and reaching 327.6 GW by the end of 2025. The Medium Scenario models up to 2030, the total solar fleet in the EU will continue its strong growth to 672 GW that year, with the annual installation rate exceeding 85 GW.